Bankrolling Bombs: How Your 401(k) Funds the War Machine and What You Can Do About It

May 14, 2025

Over the last few months, I’ve written about how weapon makers are connected to humanitarian risks, and how that translates to financial risks for 401(k) investors. In this post we’ll trace the investment chain from A to Z, showing how our savings end up flowing towards military weapon manufacturers, and how you can find sustainable funds that avoid weapon investments.

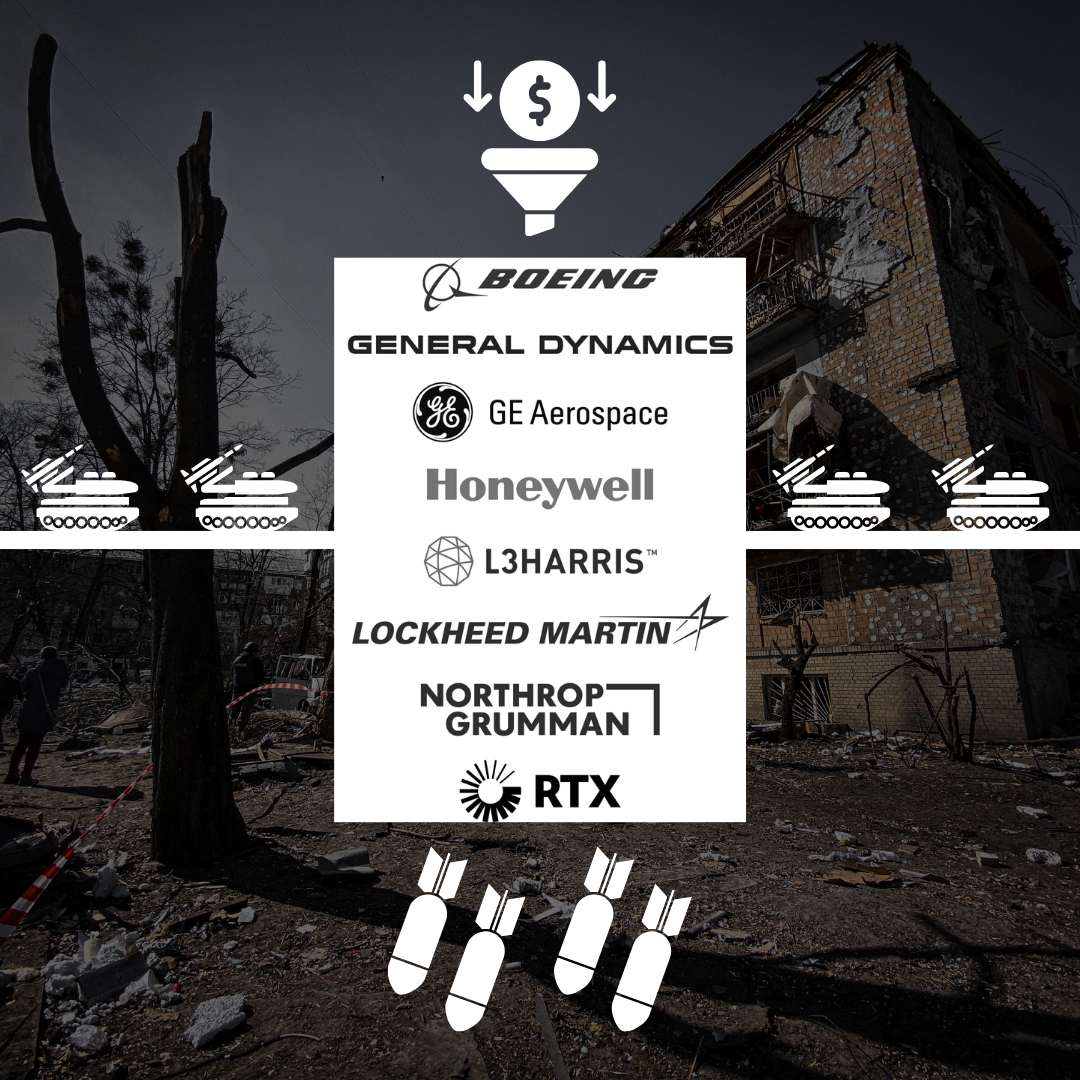

Military weapon manufacturers

The financial value chain starts with companies that make weapons and sell them to militaries around the globe. Among the largest defense contractors are many that are investor-owned, such as Lockheed Martin, RTX (formerly Raytheon), Northrop Grumman, General Dynamics, and Boeing. Each of these five major arms makers is also involved in nuclear weapon production.

As publicly traded companies, they issue stocks and bonds that investors purchase for their portfolios. Stocks represent ownership stakes in the company and come with voting rights; bonds represent loans to the company with guaranteed interest rates. If your 401(k) owns weapon maker stocks, you’re a part owner of a bomb factory. If your 401(k) owns weapon maker bonds, you’re lending out your money so the company can open more bomb factories.

When those bombs are used in attacks that kill civilians, contribute to humanitarian crises, and potentially violate international human rights law, that means your 401(k) helped pay for it, and your 401(k) profited from it. (Though not as much as you might think—weapon investments face unique financial risks).

Fund managers

Between the company’s stock and your 401(k), you’ll find fund managers like Vanguard, BlackRock, Fidelity, and State Street. These money managers bundle stocks and bonds into portfolios that are sold as mutual funds and other investment products. Here is some useful terminology:

- Mutual fund: A financial vehicle representing a portfolio of stocks and bonds. Mutual funds are the building blocks of employer-offered 401(k) plans, and they frequently hold weapon company stocks.

- Exchange-traded fund: Like a mutual fund, but it can be traded like an individual stock. Exchange-traded funds (ETFs) are less common in 401(k)s but are popular in IRAs and personal portfolios. Many ETFs are index funds.

- Index fund: Funds that track the components of a financial market index. Funds tracking popular indexes like the S&P 500 (the 500 largest U.S. companies) are often found in 401(k) plans. The S&P 500 includes more than 20 major military contractors.

- Target date fund: Balanced portfolios designed to shift risk over time to make it simpler for retirement savers to invest with the appropriate risk for their targeted retirement age (the “target date”). Many 401(k)s use target date funds as the default option.

- Sustainable fund: Funds that deliberately adopt a sustainable, responsible, or ethical investment strategy to avoid environmental and social risk factors. Sustainable funds come in different flavors, but many have weapon exclusion policies.

The fact is that many index funds and target date funds have military weapon investments. If a fund doesn’t advertise itself as a sustainable/ethical investment, there’s a good chance you’ll find companies like Lockheed Martin and RTX inside.

401(k) plans

Did you know if your employer offers a 401(k) or similar retirement plan, it has a legal responsibility, called “fiduciary duty,” to manage that plan in your best interest? Companies essentially hand off that duty to fund managers like Vanguard and BlackRock by choosing their funds for the 401(k). But when they do so, they’re not telling workers the full extent of their exposure to controversial investments like military weapons. The fund holdings are buried layers deep in legal documents, if they’re available at all.

Example: Amazon 401(k) plan

- The Amazon 401(k) is one of the largest in the U.S., with over 1.2 million plan participants and $25 billion in assets. Over 60% of that is invested in Vanguard target date funds, which are built from index funds. Most of the rest is in other index funds from Vanguard and State Street.

- Because the Vanguard Target Retirement funds are based on total market index funds, they’re virtually guaranteed to invest in every publicly traded weapon maker on the market.

- Across the entire Amazon 401(k) plan, we found $640 million in military weapon investments, accounting for over 2.5% of total plan assets.

- That includes $22 million in Lockheed Martin, $36 million in RTX, $13 million in Northrop Grumman, $13 million in General Dynamics, and $27 million in Boeing.

Is this what workers want?

In recent years, employees at some tech companies have made public calls for their employers to drop military contracts, as well as work with Immigration and Customs Enforcement. Do these employees know about military weapons in their 401(k)?

Remember, it’s not just about cutting ties to the military industrial complex. Investing in military contractors is a risky bet for your portfolio. Weapon makers can face reputational risk, litigation risk, sanctions, export restrictions, or outright bans when their products are connected to human rights violations or humanitarian crises. The evidence suggests that sustainable weapon-free investing can offer comparable returns with lower volatility.

Sustainable, weapon-free funds

Weapon-free investing has been a pillar of sustainable investing for decades. There are a healthy number of funds, across a range of asset classes, that exclude weapon investments for both financial and ethical reasons. There are weapon-free stock funds and weapon-free bond funds. There are U.S. and international weapon-free funds. There are target date funds, even index funds that exclude weapons. Many of these funds follow a holistic approach to sustainable investing that also considers climate change and other environmental and social issues.

We built our free tool Weapon Free Funds to help people know what they own and find sustainable, weapon-free funds that offer comparable returns and fit their investment circumstances. Our database tracks thousands of mutual funds and ETFs, rating them on their exposure to military contractors, nuclear weapons, and other controversial weapons like land mines and cluster bombs. You can also see exposure to fossil fuels, prisons, and other issues at the same time.

With 401(k)s, you may be restricted to a short list of funds, none of which avoid military weapons. In that case, it’s time to get organized with your colleagues and ask for sustainable funds to be added to your 401(k). We’ve got a toolkit to get you started.

It’s sobering to realize our financial connections to human rights violations and civilian deaths in violent conflicts. But by investing weapon-free, we can start to cut our financial ties to war and militarism. Check out Weapon Free Funds at www.weaponfreefunds.org.