2021 Annual Report - Finances

Finances

Ploughshares Fund is proud to report another strong year of support from our donors. To ensure maximum impact, all annual contributions go directly toward grantmaking and programmatic activity, with nothing subtracted for administration or development (these are paid for by the Fund’s Board of Directors and a draw from our capital reserve). This year 77% of our total budget was spent on grantmaking and programmatic activity.

In fiscal year 2021, Ploughshares Fund’s long-term investments gained $7,562,677 compared to a loss of $325,789 in 2020. Of the 2021 total assets, $32,148,853 is held in our long-term capital reserves, which were established to ensure our ability to continue our mission to reduce and eliminate nuclear weapons in face of the challenges and opportunities that may arise. This portfolio is actively managed by an investment committee with the counsel of an investment manager.

Financial Report 1

| SUPPORT AND REVENUE | 2021 | 2020 |

| Contributions | 5,350,404 | 7,543,575 |

| Investment return | 7,562,677 | -325,789 |

| TOTAL SUPPORT AND REVENUE | 12,913,081 | 7,217,786 |

| EXPENSES | 2021 | 2020 |

| Program Services | ||

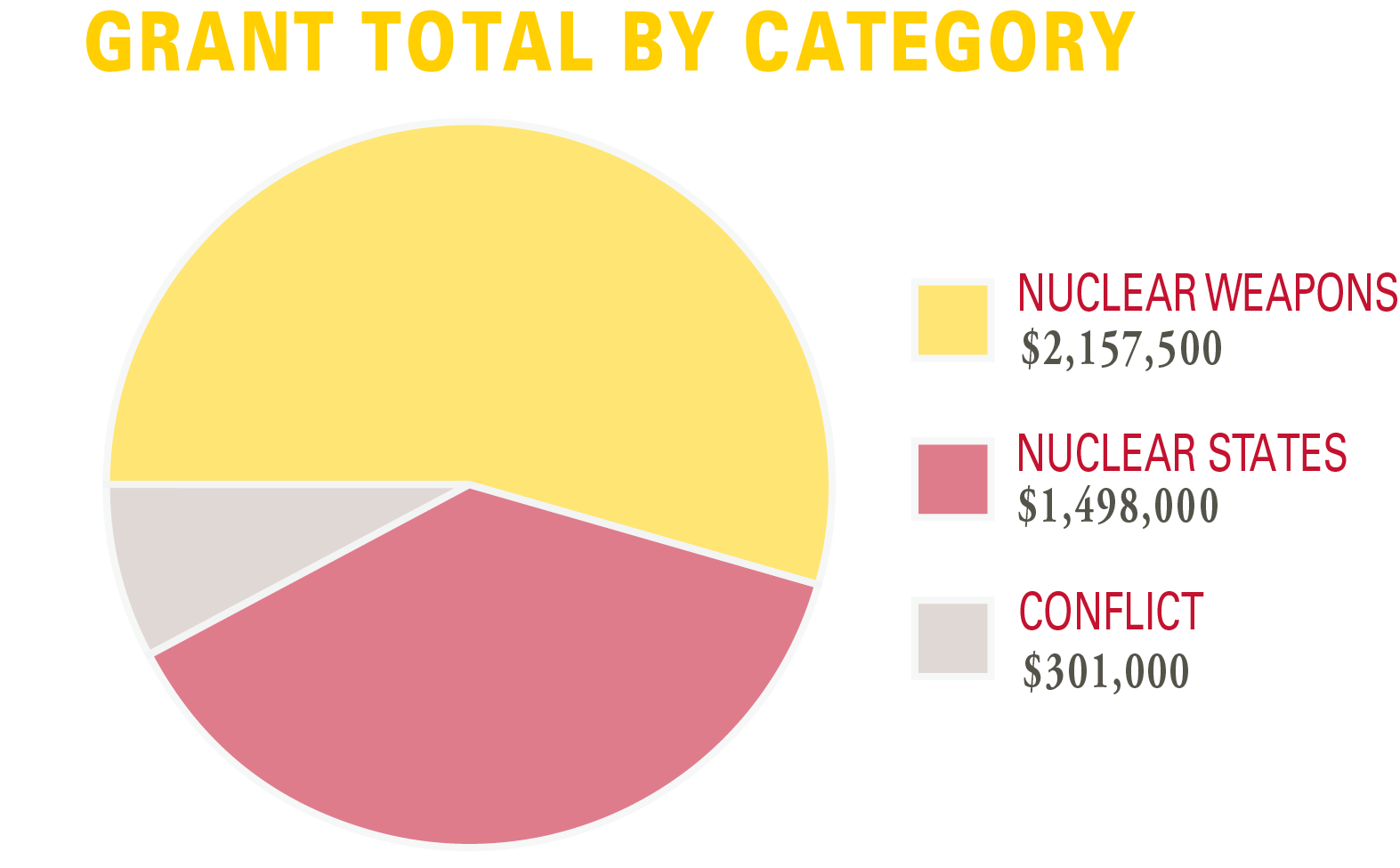

| Grants from Ploughshares Fund | 3,655,500 | 4,427,229 |

| Grants from Cowles Fund | 301,000 | 373,000 |

| Program Activity | 1,493,364 | 1,730,497 |

| Supporting Services | ||

| General administration | 649,592 | 671,673 |

| Development | 1,016,823 | 1,002,973 |

| TOTAL EXPENSES | 7,116,279 | 8,205,372 |

| ASSETS AND LIABILITIES | 2021 | 2020 |

| TOTAL ASSETS 2 | 35,002,936 | 28,889,354 |

| TOTAL LIABILITIES | 1,575,985 | 1,259,205 |

| NET ASSETS | ||

| Without donor restrictions | 4,927,722 | 2,188,599 |

| With donor restrictions | 28,499,229 | 25,441,550 |

| TOTAL LIABILITIES AND NET ASSETS | 35,002,936 | 28,889,354 |

- Complete audited financial statements areavailable upon request. The abovenumbers havebeen audited.

- These assets include investments in Ploughshares Fund’s Pooled Income Fund.